Whilst many people talk about reducing their carbon footprints, actively investing in such technologies is less common. Doing this to improve the profits of an enterprise is even more responsible.

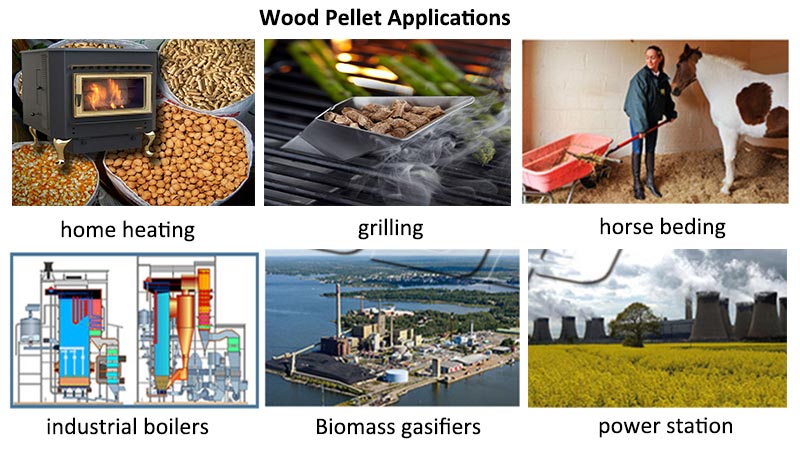

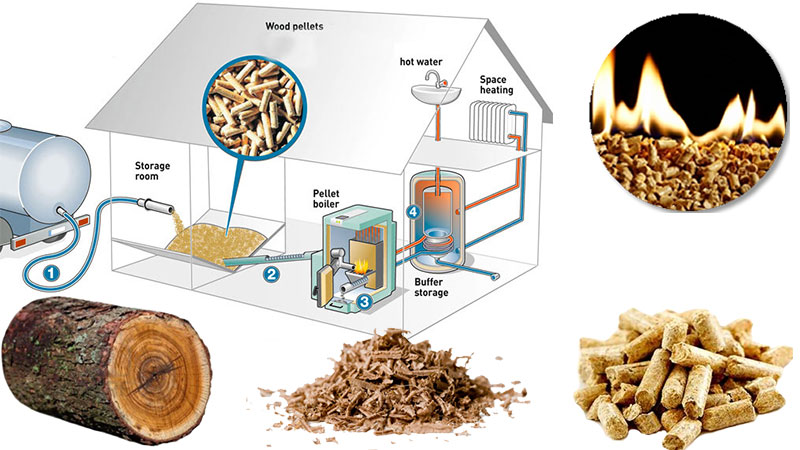

Statistics indicate that, in each of the last two years, wood fuel pellet usage has been increasing at an annual rate of 200% because wood pellets are now competing favorably on price, as well as offering neutral carbon emissions.

There are well-documented examples of large scale commercial facilities with capacities of 30,000 tonnes of wood pellets per year. There are currently 3 in the UK with plans to build more. Although this method of manufacturing is highly efficient, many of the environmental advantages are lost through the need to collect and then distribute 30,000 tonnes of materials over a very large area. Transport for collection and delivery offsets the “green” advantage.

Since the so called “credit crunch”, many businesses are suffering as a result in reduced demand for their products and are looking to diversify. Until very recently, funding for the capital outlay has represented serious problems for potential customers due to the reluctance of financial institutions to lend money. However, new government initiatives are easing the problem through a scheme to underwrite capital investment in “green” projects.

Turning waste products, or costly unwanted by-products into something of value, especially if this involves reducing carbon emissions, is good for the planet, and makes sound commercial sense.